- Introduction

- Current Trends in the U.S. Rig Count

- Factors Contributing to the Dip

- Potential Impacts on the Energy Market

- How the Industry Is Responding

- Conclusion

- FAQs

- References

Introduction

The U.S. oil and gas industry is once again in the spotlight as the number of working rigs has experienced a dip following six consecutive weeks of growth. The Baker Hughes rig count—a widely respected indicator of activity and productivity in the energy sector—offers insight into changing dynamics that affect not just industry stakeholders, but also consumers, policymakers, and investors worldwide.

In this article, we'll explore the latest trends in U.S. oil and gas rig activity, discuss the main reasons behind the recent decline, and examine how these developments might affect the broader energy market. We'll also look into how energy companies are responding to these fluctuations and what this could mean for future production capabilities.

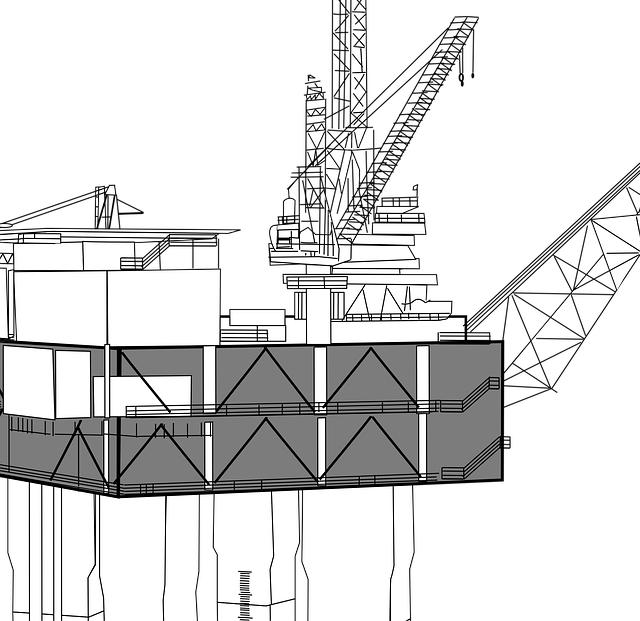

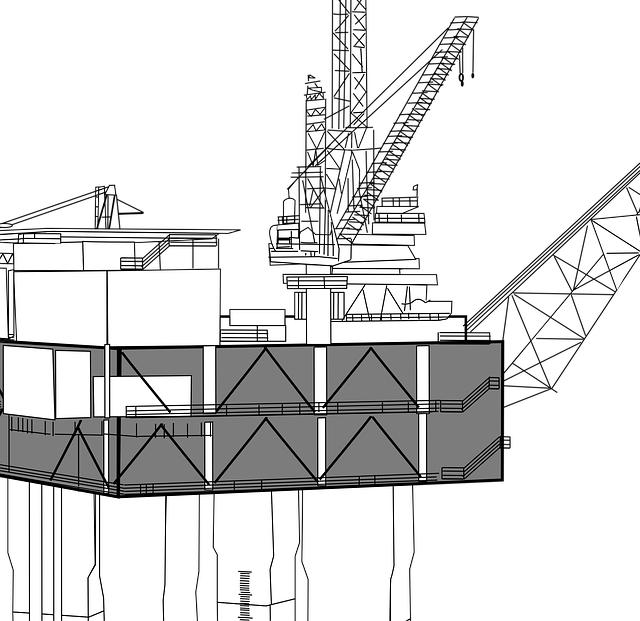

Current Trends in the U.S. Rig Count

(Image: Pixabay/@Clker-Free-Vector-Images)

According to the latest data from Baker Hughes, the number of active drilling rigs in the United States fell by several units in the first week following an extended six-week climb. As of the most recent count, the total rig number dipped slightly across both oil and gas sectors, raising questions about whether the decline is a temporary slowdown or signals a more prolonged shift.

Over recent months, the industry had been showing optimism. An increase in commodity prices and easing inflationary pressures had spurred exploration and drilling activity. This uptick was visible particularly in hotspots like the Permian Basin and the Eagle Ford shale region. However, despite those signs of momentum, the latest dip highlights ongoing volatility in fossil fuel extraction operations.

Historically, rig counts tend to follow price trends with a time delay—a phenomenon that appears to still hold true. The current data reminds stakeholders that even with upward market optimism, operational decisions remain sensitive to geopolitical tensions, supply chain disruptions, and fluctuating demand.

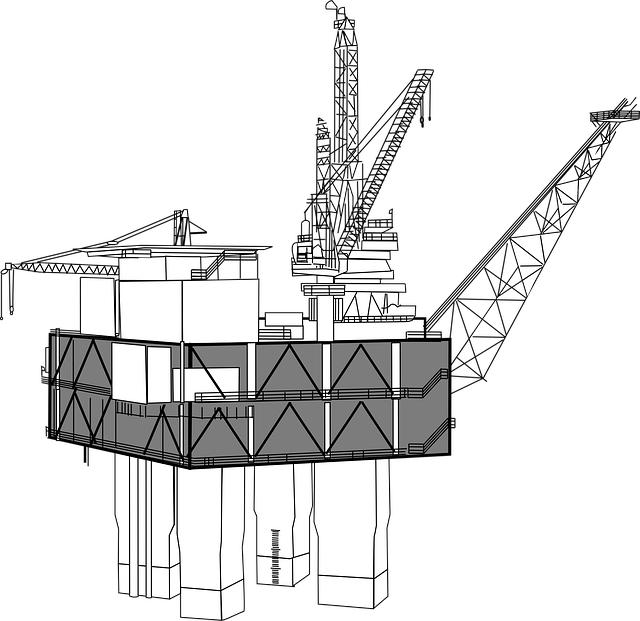

Factors Contributing to the Dip

(Image: Pixabay/@anita_starzycka)

Several interconnected factors may be influencing the recent dip in U.S. rig activity. Chief among them is the price of crude oil. While prices remain relatively high after a volatile few years, many producers are hesitant to invest heavily in new operations without clear long-term price stability. This caution often results in week-to-week differences in drilling activity.

Economic uncertainty also continues to play a role. Unstable interest rates, labor shortages in skilled oilfield workers, and increasing pressure from environmental regulations all weigh on investment decisions. As companies face increasing costs and regulatory scrutiny, many opt to tighten operations or delay expansion plans.

Additionally, international factors—such as OPEC+ output strategies and geopolitical events like the Russia-Ukraine war—continue to create ripples in global energy markets. These external pressures contribute to domestic hesitation and are clearly influencing rig deployment patterns in U.S. shale plays.

Potential Impacts on the Energy Market

(Image: Pixabay/@geralt)

The dip in active rigs, although modest, can have outsized effects on energy prices and supply downstream. If fewer wells are being drilled, production capacity may face constraints in the coming months. This scenario could lead to upward pressure on prices, especially if global demand continues to rebound post-pandemic.

For consumers, changes in rig count can eventually translate into fluctuating fuel prices at the pump. While there's generally a lag between reduced drilling and reduced supply, market analysts are quick to revise forecasts based on drilling trends. A consistent drop could shift the narrative toward tighter supplies and potentially significant market movements.

Beyond pricing, the slowdown might also influence investor confidence in small to midsize energy companies, many of which rely on contractors and partnerships to operate. Reduced drilling activity can signal potential financial uncertainty, prompting investors to reevaluate their strategies in an already complex market.

How the Industry Is Responding

(Image: Pixabay/@Clker-Free-Vector-Images)

Despite the dip in rig count, energy companies are far from passive. Many have already begun implementing measures to enhance efficiency and capitalize on existing wells. Technological innovation remains a strong focus—with operators investing in automation, real-time analytics, and optimized resource recovery systems to minimize losses and improve margins.

Some firms are diversifying their portfolios to include more renewable assets or voluntary carbon offset programs. As ESG (Environmental, Social, and Governance) compliance grows more critical, keeping investors confident means staying proactive despite short-term drilling slowdowns.

There is also a notable shift toward strategic repositioning. Companies are assessing geographic advantages, reevaluating contracts, and focusing on core assets to ensure profitability in an uncertain landscape. This strategic adaptability has been crucial to surviving, and even thriving, amid past industry downturns—and appears just as vital today.

Conclusion

While the U.S. rig count slipping after six weeks of gains may appear minor on the surface, its implications are far-reaching. From market forecasts to operational priorities, this modest statistical move serves as an indicator of underlying uncertainty and strategic recalibration in the energy sector.

The coming months will be crucial in determining whether this decline is part of seasonal fluctuation, a response to geopolitical pressures, or a harbinger of deeper shifts within the fossil fuel landscape. For stakeholders across the spectrum—from producers and investors to consumers and policymakers—keeping a close eye on rig activity remains essential in understanding the current and future state of U.S. energy production.

FAQs

What is the Baker Hughes Rig Count?

The Baker Hughes Rig Count is a weekly tally of active oil and gas rigs in North America. It's widely viewed as a barometer for industry health and drilling activity.

Why did the U.S. rig count drop after six weeks of gains?

Several factors may explain the recent dip, including fluctuating oil prices, economic uncertainty, regulatory influences, and international market pressures such as global conflicts or OPEC+ decisions.

How does lower rig activity affect fuel prices?

A drop in drilling can eventually result in reduced oil supply, which may lead to higher prices at the pump if demand remains constant or increases.

Is this decline expected to continue?

It's difficult to say. While the drop may be temporary, broader trends such as rising costs, changing regulations, and market instability point to a cautious approach by energy producers moving forward.

How are oil companies adapting?

Firms are focusing on efficiency, technology integration, diversification into renewables, and strategic consolidation of key assets to remain competitive despite market volatility.